Introduction:

Understanding Price Action and Technical Analysis in Trading, Think Like Operator: In this article, we will discuss the significance of price action and technical analysis in trading.

Table of Contents

The Importance of Price Action in Trading:

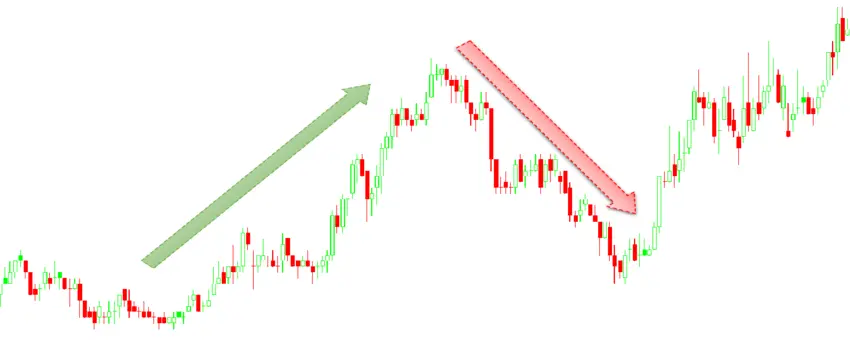

Price action refers to the movement and behavior of prices in the market. It encompasses various patterns and indicators that traders use to make informed decisions. By understanding price action, traders can identify potential trading opportunities and manage their risks effectively.

The Role of Candlestick Charts:

One of the most common tools used in price action analysis is the candlestick chart. Candlestick charts provide valuable information about the market’s sentiment and direction. They are made up of different candlestick patterns, such as doji, hammer, and engulfing patterns, which can indicate potential reversals or continuation of trends.

Read More: 5 Fibonacci Retracement Rules for using Operator Trader

The Limitations of Indicators:

While indicators can be helpful in analyzing price action, it is essential to recognize their limitations. Each trader may interpret indicators differently, leading to subjective analysis. It is crucial to develop your own trading strategy and combine indicators with other tools, such as support and resistance levels, to increase your chances of success.

The Psychological Aspect of Trading:

Trading also involves a psychological aspect that can significantly impact your decision-making process. It is essential to manage emotions like fear and greed, as they can cloud your judgment and lead to impulsive trading. Developing discipline and following a solid money management plan are key to long-term success in trading.

Understanding the Risk-Reward Ratio:

The risk-reward ratio is another crucial concept in trading. It refers to the potential profit gained compared to the amount of risk taken for each trade. Having a positive risk-reward ratio means that your potential profits are greater than your potential losses. Traders aim to find trades with a favorable risk-reward ratio to maximize their profitability.

Read More: How to Predict market buying and selling levels by using Operator’s Mind

Using the SECO Securities Trading App:

To enhance your trading journey and analyze your past mistakes, you can use the SECO Securities trading app. This app provides valuable insights into your trading performance, including success rates, average gains, average losses, and maximum profit and loss levels. By analyzing this data, you can identify patterns and areas for improvement in your trading strategy.

The Importance of Continual Learning:

It is important to note that trading is an ongoing learning process. Staying updated with market trends, studying different trading strategies, and improving your technical and psychological skills are crucial for long-term success. Continual learning and adapting to changing market conditions will help you stay ahead in the trading game.

Conclusion:

Understanding price action and technical analysis is essential for successful trading. By analyzing price patterns, using candlestick charts, incorporating indicators, managing emotions, and focusing on risk management, traders can make informed decisions and increase their chances of profitability. Remember, trading is a journey that requires continual learning and adaptation. By staying disciplined and constantly improving your skills, you can navigate the markets with confidence.

People also Ask | FAQ:

1. Which chart is best for price action?

Ans: line chart or candlestick chart.

2. Who is the best teacher of price action?

Ans: Nial Fuller.

3. What is the formula for price action trading?

Ans: {(C – O) + (C – H) + (C – L)} / 2.

4. Which time frame is best for price action trading?

Ans: A combination of the 15-minute and 30-minute time frames.

5. What is the success rate of price action?

Ans: success rate of 75% or higher.