Introduction:

In this article, we will discuss the 5 Fibonacci Retracement Rules for using Operator Trader. These rules are essential for traders who engage in operator retirement. We will provide a detailed explanation of each rule, starting from the basics and progressing towards more advanced concepts. Additionally, we will share some important insights and experiences related to this topic. So, let’s get started and learn these rules to enhance our trading skills.

Table of Contents

These is the 5 Fibonacci Retracement Rules for using Operator Trader :

Rule 1: Understanding Support and Resistance Levels:

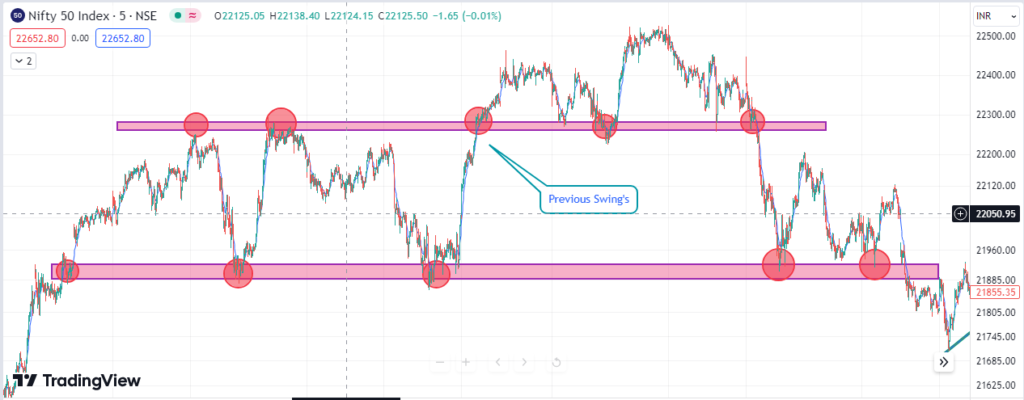

Support and resistance levels are crucial elements in trading. For those who are unfamiliar with these terms, support level refers to a price level where the market tends to stop falling, while resistance level refers to a price level where the market tends to stop rising.

In the context of operator trading, it is important to identify these levels accurately to make informed trading decisions. By observing previous swings and the consolidation of the market, you can determine the support and resistance levels. These levels play a significant role in determining the market trend and potential entry points for trades.

Read More: How to Trade on Support and Resistance by using Operator Mindset

Rule 2: Recognizing Bullish and Bearish Candlestick Patterns:

Candlestick patterns provide valuable insights into market trends and potential trading opportunities. When the market experiences a bullish movement, it indicates a rise in prices. On the other hand, a bearish movement signifies a decline in prices.

By analyzing these patterns and understanding their significance, traders can make informed decisions on when to enter or exit a trade. It is important to note that candlestick patterns work in conjunction with other technical indicators and should be used as confirmation signals to increase the probability of successful trades.

Rule 3: Utilizing the Power of Fibonacci Retracement:

Fibonacci Retracement is a powerful tool in trading that helps traders identify potential entry points. It involves waiting for the market to retrace or pullback before entering a trade in the direction of the overall trend. By using Fib retracement, traders can take advantage of better risk-reward ratios and increase their chances of profiting from the trade. It is important to wait for a confirmation signal, such as a green candle, after the retracement to ensure a high-probability trade setup.

Read More: Golden Setups for Daily Profit in Market Gap Down Open

Rule 4: Understanding the Psychology of Operators:

Operators are large market participants who have significant resources and influence over the market. They play a crucial role in manipulating the market and trapping retail traders. It is important to understand their strategies and mindset to avoid falling into their traps.

By learning about their trading patterns and behaviors, traders can make informed decisions and protect themselves from unnecessary losses. Remember, operators primarily focus on stop-loss levels of retail traders and aim to maximize their profits at their expense.

Rule 5: Mastering the Art of Exit Strategy:

Having a well-defined exit strategy is vital for successful trading. Traders should determine their profit targets and set appropriate stop-loss levels to minimize potential losses. It is important to avoid emotional decision-making and rely on predefined levels and indicators to exit a trade. By sticking to a disciplined exit strategy, traders can maintain control over their trades and protect their capital. Remember, a proper exit strategy ensures that traders are not dependent on the market and can make decisions based on their own analysis.

Conclusion:

In conclusion, the 5 Fibonacci Retracement Rules for using Operator Trader provide valuable insights into successful trading strategies. By understanding support and resistance levels, recognizing candlestick patterns, utilizing retracement, understanding operator psychology, and mastering exit strategies, traders can enhance their trading skills and increase their profitability. It is important to continuously learn and focus on improving trading knowledge to navigate the market effectively. Remember, trading is a continuous learning process, and by implementing these rules, traders can make informed decisions and achieve long-term success.

People Also ask Question | FAQ:

1. How to use fib retracement in trading?

Ans: For downtrends, click on the Swing High and drag the cursor to the most recent Swing Low. For uptrends, do the opposite.

2. Do professional traders use Fibonacci?

Ans: Every foreign exchange trader will use Fibonacci retracements at some point in their trading career.

3. What is Fibonacci golden ratio?

Ans: A ratio between two numbers that equals approximately 1.618.

4. Which timeframe is best for Fibonacci retracement?

Ans: 30-to-60-minute candlestick chart.

5. Which Fibonacci indicator is best?

Ans: MACD.