Introduction:

Welcome to my article, where I will be discussing a The Secret Trading Strategy of an Operator in the stock market. Operators are traders who make profitable positions before the market moves. As retail traders, we often struggle to identify these positions.

In this article, I will introduce you to a website that can help you determine the positions created by operators, whether they are bearish or bullish. This strategy has a high level of accuracy and can help you make daily profits.

Table of Contents

Understanding the Website:

Before going into the details of the strategy, let’s talk about the website that provides all the necessary data for analysis. After logging into the website, you can navigate to the options section and select “Call OI & Put OI“. Here, you will find data that shows the positions created by operators. By analyzing this data, you can determine whether the market is expected to go up or down.

Option Chain:

It is important to understand the concept of an option chain before utilizing this strategy. An option chain shows the call and put options and their respective open interest (OI). If the put OI is higher, it indicates a bullish view from the option buyers. On the other hand, if the call OI is higher, it indicates a bearish view from the option buyers. By considering this information, you can make informed trading decisions.

The Secret Strategy of an Operator:

Application of the Strategy:

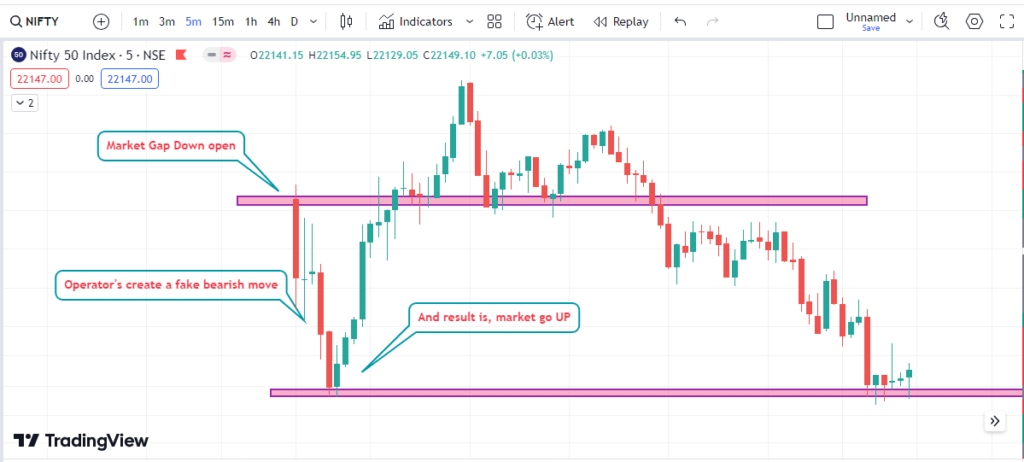

Now, let’s explore how this strategy works in real-time Trade conditions. We will analyze the market movements on a specific day to understand the strategy’s effectiveness.

Market Analysis:

On the second of February, the market appeared to be moving downwards. However, the data on the website provided a different perspective. The put OI was increasing, indicating a bearish view from option sellers. Meanwhile, the call OI remained stagnant. This discrepancy suggested that the market might go against retail traders’ expectations and move upwards.

As the market opened, the gap down created a fear among retail traders. They anticipated a breakdown, but the market showed a bounce back. This moment generated a strong momentum of approximately 450 points. Retail traders were trapped by their bearish assumptions, while operators created profitable positions.

Utilizing the Website:

The website updates live data, allowing you to monitor the market movements and operator positions. By keeping an eye on the option chain and observing the increasing put writers or call writers, you can predict the market direction. Whenever the market crosses the put or call crosses, it provides an opportunity to enter a position accordingly.

Website Link: www.niftytrader.in

It is worth noting that this strategy minimizes the chances of loss as you are aligning your position with the operators. The accuracy of this strategy is high, and it can be further tested in live trading.

Conclusion:

The secret strategy of an operator is a powerful tool for retail traders to make profitable trades. By utilizing the information provided by the website, you can accurately predict the market direction and enter positions accordingly. This strategy minimizes the chances of loss and allows you to align with the operators’ positions. If you have any questions or doubts about this strategy, feel free to comment, and I will provide answers and further guidance.

People also Ask Question | FAQ:

1. What is the trick for option trading?

Ans: Avoid options with low liquidity; verify volume at specific strike prices.

2. What is the most profitable option strategy?

Ans: Bull Call Spread.

3. How do you never lose in option trading?

Ans: Always try to hedge your position.

4. What is the best stop-loss for intraday trading?

Ans: Set the stop-loss level between 1% to 3% below the purchase price.

5. Which is more profitable intraday or options?

Ans: Intraday trading is a better option than positional trading.