Introduction to Smart Money Concept:

The smart money concept has gained popularity on the internet as a trading strategy. Many claim that it can bring massive profits, but is it really possible? In this complete article, on the smart money concept, you will learn how to apply it step by step, when to apply it, and when not to. This article aims to clarify the concept and provide valuable insights into how to use it effectively in trading.

Table of Contents

Origin of the Smart Money Concept:

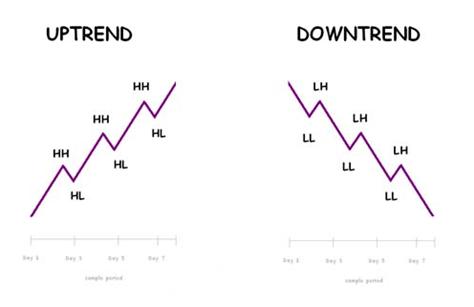

The concept of smart money originated from the Dow theory, known as the father of technical analysis. According to this theory, price movements form specific patterns, such as higher highs and higher lows in an uptrend. Understanding these patterns and their significance is crucial for implementing the smart money concept effectively.

Strategies of Smart Money Concept:

The smart money concept is based on identifying and leveraging higher highs and higher lows to make informed trading decisions. Implementing this concept involves recognizing specific candlestick patterns, marking trend lines, and using indicators like Heiken Ashi candlesticks to identify opportunities for buying and selling.

Fair Value Gap and Demand Zones:

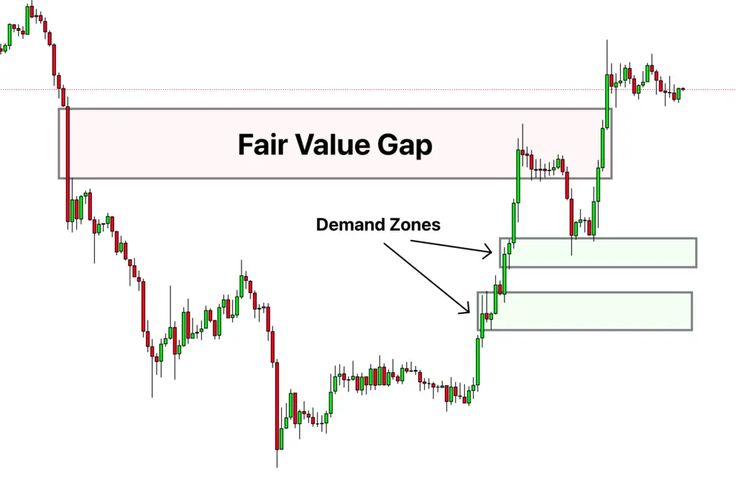

Understanding the fair value gap and demand zones is essential for successful trading with the smart money concept. The fair value gap reflects pending orders waiting to be executed, often leading to rapid price movements. Learning to identify demand zones and fair value gaps can significantly enhance trading strategies.

Understanding the Fair Value Gap:

The fair value gap is a critical concept in trading, reflecting pending orders that can lead to sudden price movements. This gap often influences buying and selling decisions, and understanding its dynamics is crucial for effective trading strategies.

Operational Mechanics of Fair Value Gap:

Understanding how the fair value gap operates involves recognizing the presence of pending orders and their impact on market dynamics. The mechanics of the fair value gap play a significant role in influencing buying and selling momentum, making it a crucial aspect for traders to consider.

Strategies for Trading Around Fair Value Gap:

Developing effective trading strategies around the fair value gap involves identifying demand zones and considering potential price movements. By strategically placing orders around the fair value gap, traders can take advantage of rapid price movements and enhance their trading success.

Fundamentals of the Smart Money Concept:

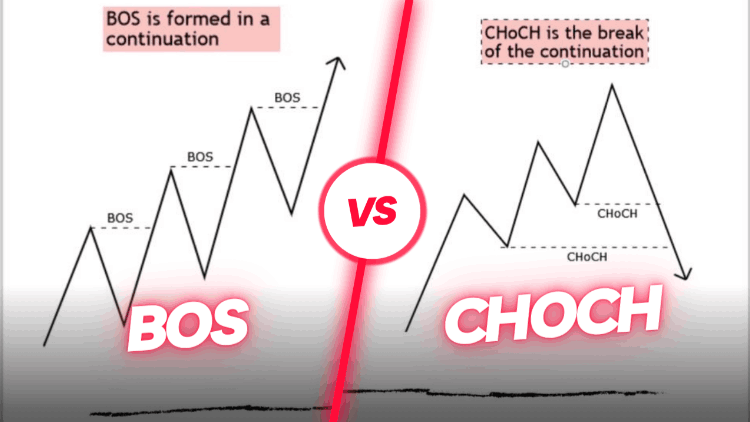

The smart money concept is a trading strategy that has gained popularity on the internet. It is based on higher highs and higher lows in an uptrend, originating from the Dow theory, known as the father of technical analysis. This concept is a one-stop video explanation that teaches you where to take a trade and how to mark it. The smart money concept is based on the principles of higher highs and higher lows, also known as BOS (Breakout of Structure) and CHOCH (Change of Character).

Strategies for Trading Around Smart Money Concept:

Implementing the smart money concept involves recognizing specific candlestick patterns, marking trend lines, and using indicators like Heiken Ashi candlesticks to identify opportunities for buying and selling. Traders can use the fair value gap and demand zones to enhance their trading strategies and take advantage of rapid price movements.

Operational Mechanics of Smart Money Concept:

Understanding the operational mechanics of the smart money concept involves recognizing the presence of pending orders and their impact on market dynamics. Traders can strategically place orders around the fair value gap to take advantage of rapid price movements and enhance their trading success.

Implementing the Smart Money Concept in Trading:

The smart money concept has gained popularity on the internet as a trading strategy. It is based on the principles of higher highs and higher lows, also known as BOS (Breakout of Structure) and CHOCH (Change of Character). Implementing this concept involves recognizing specific candlestick patterns, marking trend lines, and using indicators like Heiken Ashi candlesticks to identify opportunities for buying and selling.

Operational Mechanics of Smart Money Concept:

Understanding the operational mechanics of the smart money concept involves recognizing the presence of pending orders and their impact on market dynamics. Traders can use the fair value gap and demand zones to enhance their trading strategies and take advantage of rapid price movements.

Strategies for Trading Around Smart Money Concept:

Traders can strategically place orders around the fair value gap to take advantage of rapid price movements and enhance their trading success. Recognizing specific candlestick patterns, marking trend lines, and using indicators like Heiken Ashi candlesticks can help identify opportunities for buying and selling.

Enhancing Your Trading with the Fair Value Gap:

The fair value gap is an essential concept in trading, reflecting pending orders that can lead to sudden price movements. Traders can strategically place orders around the fair value gap to take advantage of rapid price movements and enhance their trading success. Understanding how the fair value gap operates involves recognizing the presence of pending orders and their impact on market dynamics. Traders can use the fair value gap and demand zones to enhance their trading strategies and take advantage of rapid price movements.

Operational Mechanics of Fair Value Gap:

Understanding how the Fair Value Gap ( FVG) operates involves recognizing the presence of pending orders and their impact on market dynamics. The mechanics of the fair value gap play a significant role in influencing buying and selling momentum, making it a crucial aspect for traders to consider.

Strategies for Trading Around Fair Value Gap:

Developing effective trading strategies around the fair value gap involves identifying demand zones and considering potential price movements. By strategically placing orders around the fair value gap, traders can take advantage of rapid price movements and enhance their trading success.

Smart Money Concept Free PDF Download:

Related Questions:

Q. What is the smart money concept for trading?

Ans: In the world of finance, the Smart Money Concept (SMC) refers to the investment decisions made by experienced traders.

Q. Is Smart money concept profitable?

Ans: Yes, it is profitable as the managers of such funds are believed to have more effective investment strategies that diverge from those of individual retail investors.

Q. Who invented SMC trading?

Ans: Smart Money Concepts originated with The Inner Circle Trader (ICT), which is a program offered by a trader named Michael J. Huddleston.

Q. Who is best SMC trader?

Ans: Rakesh Jhunjhunwala: He is one of India’s most successful SMC traders and investors, known as the “Warren Buffett of India”

Q. What is the best timeframe for SMC trading?

Ans: The SMC trading strategy works better when employing a longer time frame (4 hours) for technical analysis and a shorter time frame (15 minutes) to get your entry points.